The True Colors IPO is not just another listing on the Indian stock market. It reflects a larger transformation happening within India’s textile sector — a shift driven by digital adoption, modernization of traditional workflows, and the rise of integrated supply chains. As demand grows for faster, cleaner, and more flexible printing methods, digital textile printing is emerging as a key engine of growth. Therefore, this IPO signals where the industry must head next.

A Strategic IPO Fueling Digital Innovation

True Colors raised ₹127.96 crore through its IPO, with a price band of ₹181–191 per share and a lot size of 600 shares.

It included:

- A fresh issue of up to 57 lakh shares

- An offer for sale of up to 10 lakh shares

Because a large portion is a fresh issue, funds will directly support expansion and technology upgrades. Moreover, strong subscription levels clearly indicate investor confidence in digital-led textile businesses.

The IPO proceeds are primarily allocated for:

- Strengthening working capital

- Reducing debt

- Expanding supply-chain footprints in regional clusters

- Enhancing digital printing capabilities

This strategic utilization supports both business growth and broader industry upliftment.

Why the True Colors IPO Matters for the Textile Landscape

Transition Toward Integrated Manufacturing Models

Historically, Indian textile units sourced machines, inks, and printing services from separate vendors.

However, customers now seek:

- Faster delivery

- Lower inventory loads

- Quick style changes

- Eco-friendly production

True Colors already operates across all three critical segments:

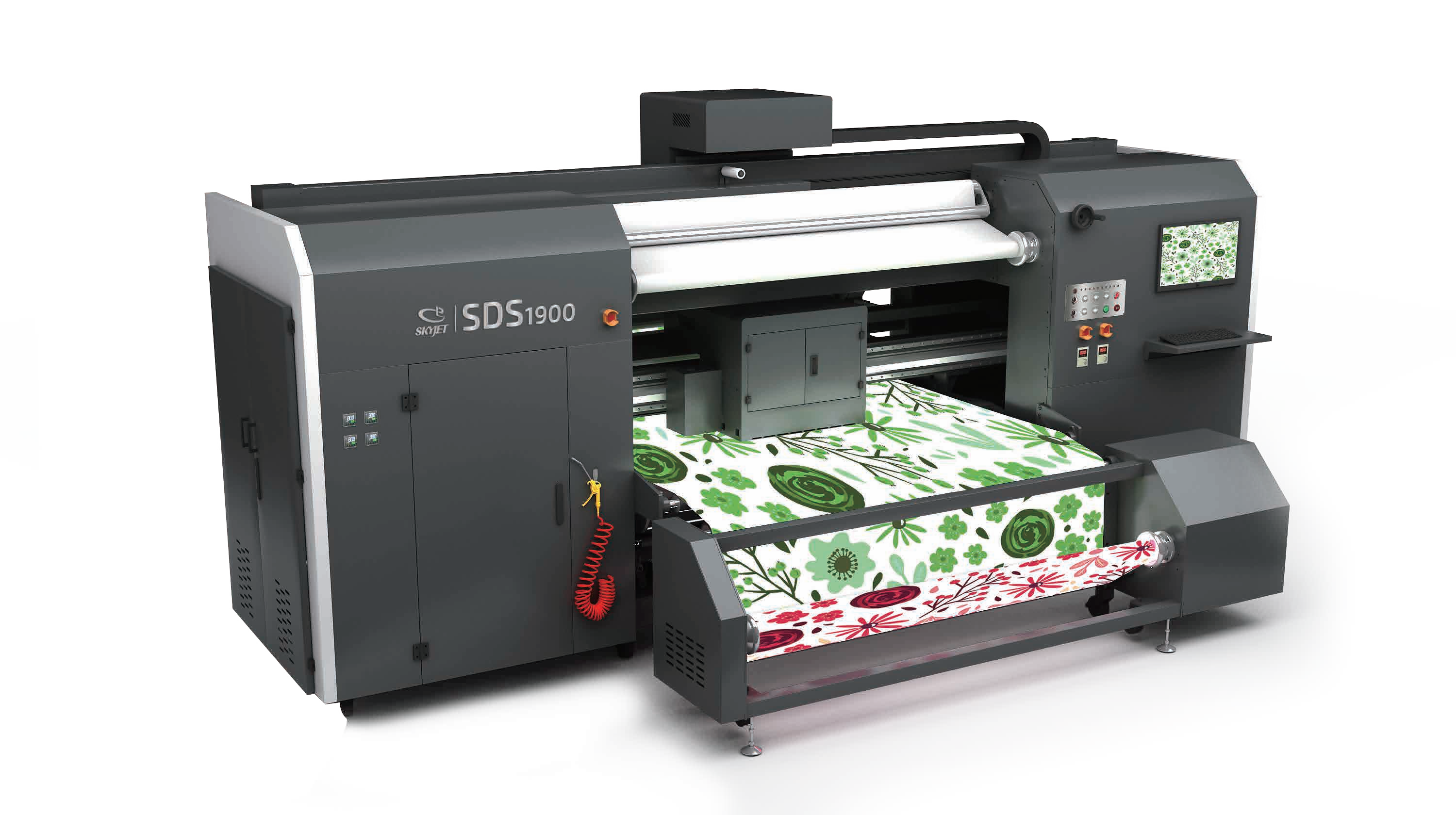

- Importing and distributing digital textile printers and inks

- Manufacturing sublimation papers

- Providing job-work printing for cotton, silk and synthetic fabrics

Therefore, the company’s integrated business model directly aligns with future industry needs.

Expanding Domestic Strength With Global Ambition

With operations rooted in major textile centers like Surat, Panipat, and Tirupur, True Colors plays an instrumental role in powering regional manufacturing. Additionally, India’s export competitiveness depends heavily on high-speed and low-waste printing. Digital textile printing enables both.

Thus, the IPO strengthens India’s vision of becoming a global textile powerhouse, not just a low-cost production hub.

Industry-Wide Implications of the True Colors IPO

The market is clearly signaling strategic priorities:

- Invest in digital to stay competitive

- Shorter supply chains increase margin and speed

- Sustainability is now central, not optional

- Smaller manufacturers must upgrade or collaborate

Consequently, the True Colors IPO sparks momentum for a more advanced, future-ready manufacturing sector.

Conclusion

The True Colors IPO represents more than financial growth — it symbolizes a new direction for Indian textile manufacturing. The future demands digital-first operations, integrated systems, faster turnaround, and sustainable processes. True Colors is already delivering on this blueprint.

As the textile industry continues to evolve globally, companies that embrace advanced printing ecosystems today will define tomorrow’s market leaders.

True Colors isn’t just part of this future — it is helping build it.